Benefit In Kind Malaysia 2019 Car

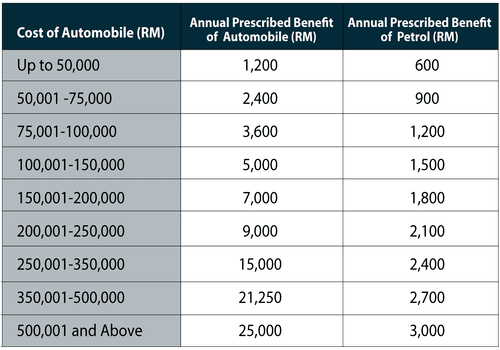

The following table provides the value of such benefits to be assessed.

Benefit in kind malaysia 2019 car. Car and related benefits. 2 2 however there are certain benefits in kind which are either exempted from tax or are regarded as not taxable. In the case where motor cars are provided the benefits to be assessed will be the private use of the car and fuel. Relevant provisions of the law 1 3.

5 2019 inland revenue board of malaysia date of publication. 3 2013 date of issue. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. Benefits in kind biks are benefits provided to the employee by or on behalf of the employer that cannot be converted into money.

Income attributable to a labuan business. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. A further clarification on benefits in kind in the form of goods and services offered at discounted prices. Objective the objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and.

Outside malaysia not exceeding one passage in any calendar year subject to a maximum of rm3 000. When an employee is provided with a car for private usage the benefit is a taxable income of the employee and the employer is required to report this benefit in his employer tax return form e and in the form ea of the employee. 19 november 2019 4 2 perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment. 2 2004 issued on 8 november 2004.

15 march 2013 pages 1 of 31 1. Inland revenue board of malaysia benefits in kind public ruling no. 11 2019 date of publication. Be aware that the diesel non rde2 supplement is now 4 and is expected to still be applicable in 2020 21.

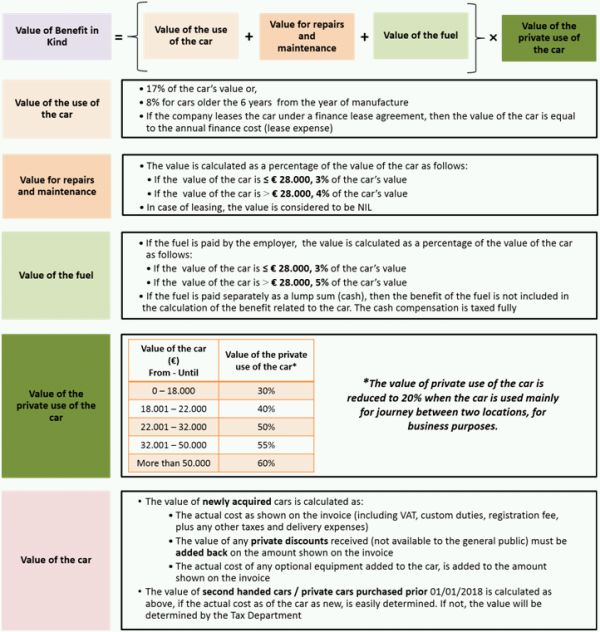

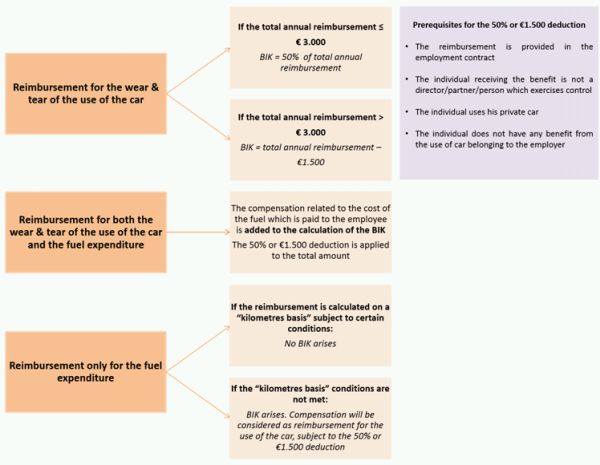

Living accommodation benefit. This company car tax table shows the bik rate bands based on co2 emissions. Perquisites are taxable under paragraph. Benefits in kind 2 5.

Motor cars provided by employers are taxable benefit in kind. Motor cars and related benefit. Company car tax benefit in kind bik rates table 2019 20 to 2020 21. Inland revenue board of malaysia benefits in kind public ruling no.

When taxable biks must be added to the payroll so they can be included in the pcb calculation. A car which is provided to the employee is regarded to be used privately if. Ascertainment of the value of benefits in kind 3 6. So going back to questions 1 the benefits on the value of private use of the car and petrol provided is benefit in kind and taxable to the person receiving the benefit.