Benefit In Kind Malaysia Car

2 3 from the year of assessment 2008 the following benefits in kind are also exempted from tax.

Benefit in kind malaysia car. The explanations provided in this addendum in relation to the exemption on certain benefits in kind are as provided under the income tax exemption order 2009 p u. 2 3 1 a discounted price for consumable business products of the employer i. 12 december 2019 page 1 of 27 1. So going back to questions 1 the benefits on the value of private use of the car and petrol provided is benefit in kind and taxable to the person receiving the benefit.

Please remember that you still need to pay tax for your benefits in kind after you have fully claim rm50 000 rm100 000 capital allowance on motor vehicle. 11 2019 date of publication. Based on formula or prescribed value method. The government has stated this will remain in place until april 2021.

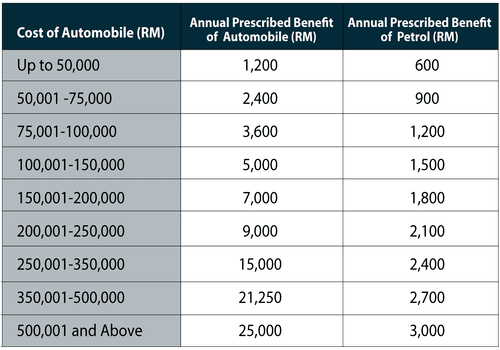

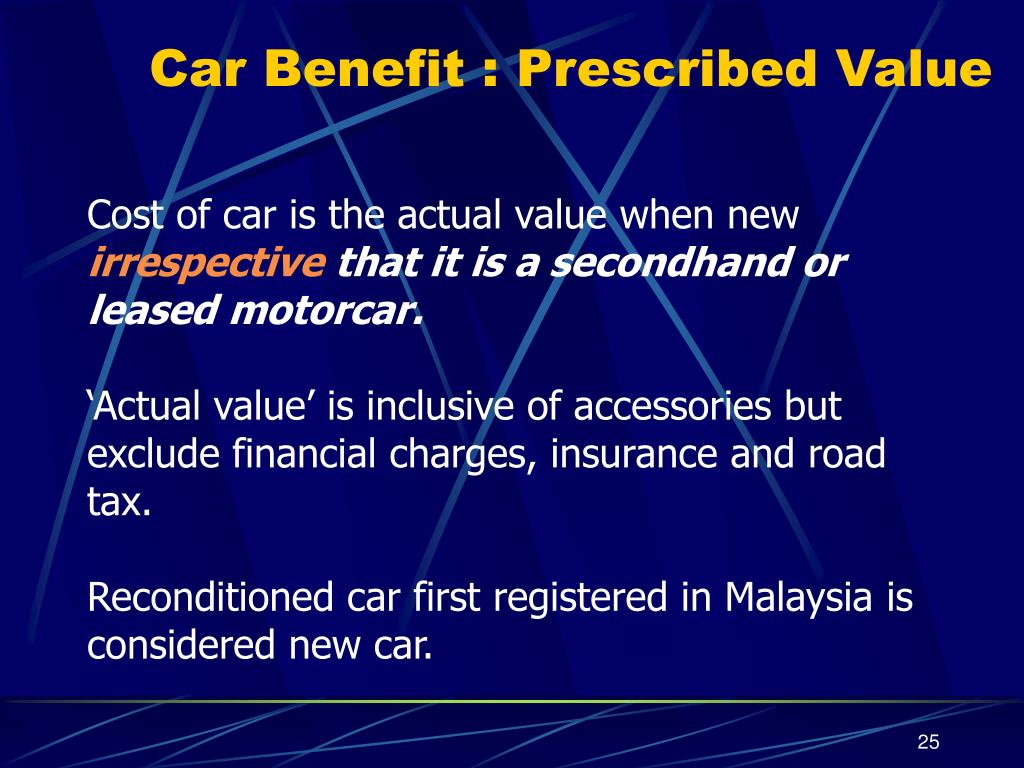

Directors of controlled companies. 3 2013 date of issue. Car and related benefits provided to employees for private usage. The following table provides the value of such benefits to be assessed.

Inland revenue board of malaysia benefits in kind public ruling no. Diesel company cars incur an additional 3 benefit in kind tax supplement up to a maximum of 37. Perquisites means benefits that are convertible into money received by an. Motorcar and petrol driver gardener etc.

When taxable biks must be added to the payroll so they can be included in the pcb calculation. Outside malaysia not exceeding one passage in any calendar year subject to a maximum of rm3 000. 15 march 2013 pages 3 of 31 b any appointment or office whether public or not and whether or not that relationship subsists for which the remuneration is payable. Residential accommodation provided to employees.

In the case where motor cars are provided the benefits to be assessed will be the private use of the car and fuel. Inland revenue board of malaysia benefits in kind public ruling no. Motor cars and related benefit. Housing accommodation unfurnished employee or service director.

Common benefits in kind biks some of the common biks include. Benefit in kind rates. The table below shows bik tax bands based on vehicle co2 emissions. Benefits in kind biks are benefits provided to the employee by or on behalf of the employer that cannot be converted into money.

Bik bands have currently been set until 2019 20. Objective the objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Motor cars provided by employers are taxable benefit in kind. We will not discuss tax deduction in interest payment and balancing charge for disposal of motor vehicle as there are too many uncertainties.